Why Do Choirs Need a Professional Cashbook?

Financial management is one of the most important tasks in any choir or ensemble. Membership fees must be managed, concert revenues correctly recorded, expenses for sheet music and events documented. This is not just about order and overview, but also about legal requirements. Associations must maintain their finances transparently, withstand cash audits, and be able to provide evidence for grant providers or tax authorities when needed.

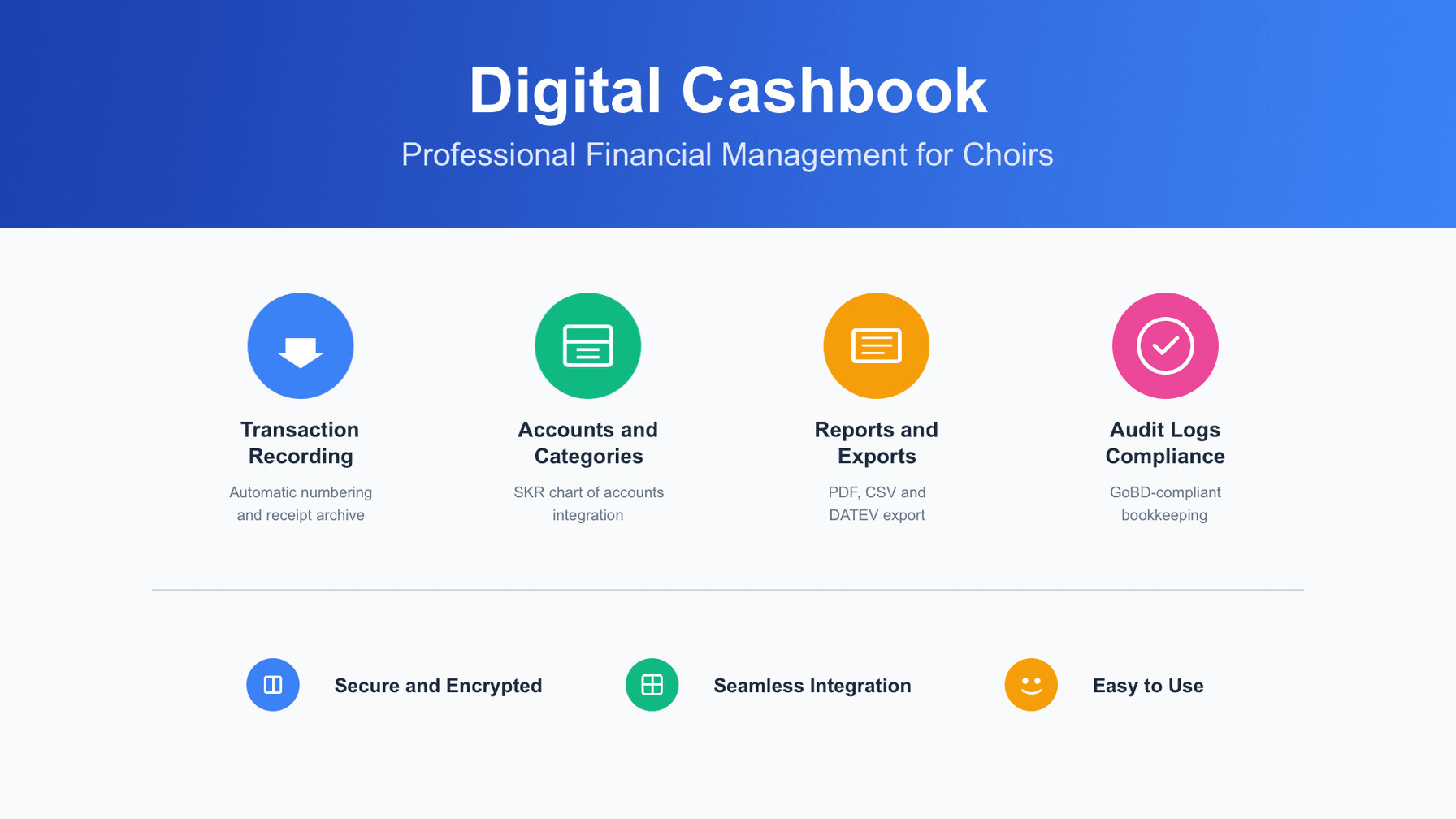

Many choirs still keep their cashbooks with Excel spreadsheets or even handwritten records. These methods are time-consuming, error-prone, and often don't meet the requirements for proper bookkeeping. When the treasurer changes, valuable knowledge is lost. When the cash audit is due, receipts must be laboriously collected. The Chorilo Cashbook solves these problems with a well-thought-out digital solution specifically tailored to the needs of choirs and ensembles. It combines simple operation with professional features and makes financial management a task that no longer takes hours, but minutes.

Recording Transactions – Fast and Structured

The heart of any financial management is recording income and expenses. In the Chorilo Cashbook, this happens through a clear form that requests all relevant information without overwhelming. You enter the transaction date, select the affected account, assign the transaction to a category, and enter the amount. A description helps later with tracking, and optionally you can add information about the counterparty, VAT, or reference numbers.

Particularly practical is the automatic receipt numbering. The system assigns a unique receipt number for each transaction following the pattern Year-Number, for example 2025-00001. This numbering is continuous and traceable, which is important during audits. For each transaction, you can upload digital receipts. Invoices, receipts, or bank statements are directly linked to the transaction and securely stored. When a cash audit takes place later or you want to look up a receipt, you'll find it with just a few clicks.

Accounts and Categories for Perfect Overview

A professional cashbook works with accounts and categories. Accounts represent your money sources – the association cash box, the bank account, perhaps a PayPal account. Each account has an opening balance and develops through income and expenses. In the Chorilo Cashbook, you can create any number of accounts and assign the right account to each transaction. This way you always keep track of how much money is available where.

Categories help you structure your income and expenses. Typical categories for choirs are membership fees, concert revenues, sheet music purchases, room rental, or travel costs. You can create your own categories that exactly fit your ensemble and organize them hierarchically. Main categories like "Income" or "Expenses" can have subcategories that are even more detailed. This structure makes later evaluations much more meaningful.

For associations that need proper bookkeeping according to German standards, the cashbook offers integration with the SKR chart of accounts. SKR stands for Standard Chart of Accounts and is a system that standardizes business transactions. The Chorilo Cashbook supports both SKR 49 for associations and federations as well as SKR 42 for associations and non-profit organizations. You can assign an SKR account to each transaction, which is especially helpful when working with tax advisors or for DATEV exports.

Dashboard and Reports for Financial Clarity

Numbers alone say little if they're not processed. The Chorilo Cashbook therefore offers a clear dashboard that shows the most important key figures at a glance. You see the current total balance across all accounts, the income and expenses of the current month, and the latest transactions. This overview immediately gives you a sense of your ensemble's financial situation.

Various reports are available for deeper analysis. The annual report shows income and expenses grouped by categories and calculates the annual result. This way you can see at a glance where most money came from and what it was spent on. The asset statement lists all accounts with their opening and closing balances and shows the change over a selected period. These reports are valuable not only for internal planning but also for member meetings where the treasurer gives account.

A special highlight is the cash audit report. This report was specifically developed for cash audits in associations and follows the classic scheme: opening balance plus income minus expenses equals the calculated closing balance. This is then compared with the actual balance of all accounts. If everything is correct, the report shows green that the cash management is correct. If there are discrepancies, they are highlighted in red. The report even contains signature fields for treasurer and auditor and can be printed directly.

Export Functions for Every Need

Having data in the system is good, being able to use it outside is better. The Chorilo Cashbook offers extensive export functions that cover various use cases. The simplest export is CSV format, which can be opened with Excel, LibreOffice, or other spreadsheets. You can choose a time period and receive a file with all transactions including date, receipt number, description, category, amount, and other details.

For professional reports, the PDF export is suitable. Here the transactions are output in an attractively formatted document that you can print directly or send by email. The PDF contains a summary with total income, total expenses, and balance as well as a detailed listing of all transactions. The special reports like annual report, asset statement, and cash audit report can also be exported as PDF.

For associations working with tax advisors or accounting software, the DATEV export is indispensable. DATEV is the standard in German accounting, and the Chorilo Cashbook can export your transactions in this format. The file contains all necessary information such as debit account, credit account, amount, booking date, and booking text. Your tax advisor can import this file directly into their software, which saves time and avoids errors.

Audit Logs for Complete Traceability

Transparency and traceability are essential in association work. The Chorilo Cashbook therefore logs every change in an audit log. When a transaction is created, edited, or deleted, this is recorded with timestamp, user, and the changed data. These logs are immutable and cannot be manipulated retrospectively.

This function is important not only for cash audits but also for internal control. If multiple people have access to the cashbook, you can always trace who made which changes when. This creates trust and prevents misunderstandings. Even with accidental deletions, you can trace what happened using the logs and restore data if necessary.

Permissions and Data Security

Not everyone in the ensemble should have access to all financial data. The Chorilo Cashbook works with a well-thought-out permission system. Administrators have full access and can use all functions. Moderators can record and edit transactions but don't have access to sensitive functions like deleting accounts or changing permissions. Regular members have no access to the cashbook, which ensures the confidentiality of financial data.

Financial data is sensitive and must be specially protected. The Chorilo Cashbook meets the highest security standards. All data is transmitted and stored encrypted. Regular backups ensure that your data is not lost even in case of a technical problem. The servers are located in Germany and are thus subject to strict German data protection laws.

GoBD-Compliant Bookkeeping

The Chorilo Cashbook meets the requirements of GoBD (Principles for the proper management and storage of books, records, and documents in electronic form as well as for data access). This means specifically: Each transaction receives a continuous receipt number and can no longer be changed retrospectively. Changes are only possible within 24 hours of creation and exclusively for notes. After that, only cancellation with mandatory specification of the cancellation reason is allowed.

All changes are logged in a complete audit trail that shows who changed what and when. These logs can be exported as a CSV file and serve as proof during audits. Transactions can be marked as reconciled, which permanently locks them. Period closures allow entire time periods to be closed – after that, no new transactions can be created in this period and existing transactions can no longer be changed or cancelled. Digital receipts can be uploaded directly with the transaction or retrospectively and are permanently linked to the transaction.

Integration and Easy Start

A major advantage of the Chorilo Cashbook is the seamless integration into the entire Chorilo platform. You already use Chorilo for your rehearsal management, sheet music management, and communication. The cashbook fits perfectly into this environment. You don't have to log into a separate system or synchronize data between different platforms. Everything runs centrally through Chorilo.

Getting started with the Chorilo Cashbook is incredibly simple. You first create your accounts – for example, association cash box and bank account – and enter the current balances. Then you define categories for your typical income and expenses. After that, you can immediately start recording transactions. The system guides you through each step and offers assistance where needed. The Chorilo team continuously develops the cashbook and adds new features based on user feedback.

Transparency That Creates Trust

In the end, a cashbook is about more than just numbers. It's about trust. Members trust that their contributions are properly managed. Boards trust that cash management is correct. Grant providers trust that their funds are used appropriately. The Chorilo Cashbook creates this trust base through transparency, traceability, and professional documentation.

When the cash report is presented at the next member meeting, you can generate meaningful reports with just a few clicks that everyone understands. When the cash audit is due, you have all receipts digitally available and can print the audit report directly. When a grant application needs to be submitted, you export the relevant data in seconds. This efficiency and professionalism strengthens trust in your association work and gives you the certainty that your financial management meets the highest standards.

Start Now with Professional Financial Management

Financial management doesn't have to be a tedious duty. With the right tool, it becomes a task that is quickly completed while delivering the highest quality. The Chorilo Cashbook offers you exactly this tool – well-thought-out, user-friendly, and professional. If you already use Chorilo, you can activate the cashbook immediately and start recording your finances. If you don't know Chorilo yet, now is the perfect time to get to know the platform. Register for free, create your ensemble, and discover how modern technology facilitates association work. Your finances deserve management that is transparent, secure, and efficient. With the Chorilo Cashbook, you have exactly that.

Ready for Modern Choir Management?

Test Chorilo free for 60 days and revolutionize your choir work.

No credit card required • Full feature access • Cancel anytime